The Interplay between Bitcoin and Altcoins

Guides

July 18, 2020

One fantastic dimension with digital-assets is the spiraling number of Altcoins exchanging around. So, what are Altcoins, and how distinct are they from Bitcoin?

The inception of BTC was shrouded with huge misconceptions. Folks doubted the existence of the blockchain in the first place. Fast forward through the last decade, we have close to six thousand altcoins.

Aside from clarifying what Altcoins are, there is a broad concept as to why they exist.

What are Altcoins?

Altcoins are all other digital assets other than the original one -Bitcoin (BTC). All altcoins borrow from the precedence set by BTC.

How? Every digital asset has a blockchain of its own.

Examples of Altcoins

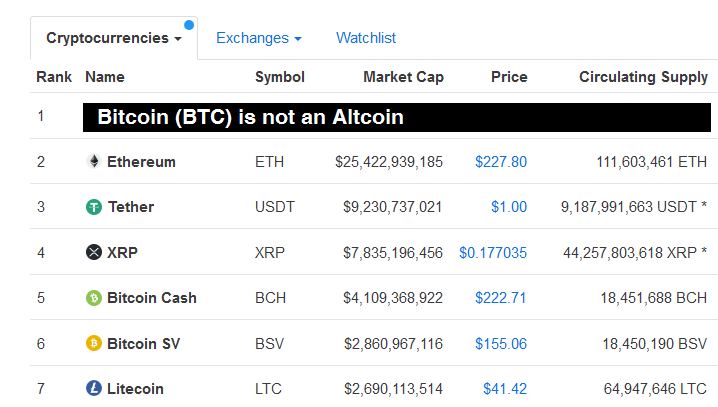

Coinmarketcap lists the top 6 altcoins (with their recognized symbols) as:

- Ethereum(ETH)

- Tether(USDT)

- XRP(XRP)

- Bitcoin cash (BCH)

- Bitcoin SV (BSV)

- Litecoin(LTC)

Image credit: https://coinmarketcap.com/

Most Altcoins pick symbols that resemble their generic names. As a user, you require to note a few that deviate from that norm. For instance, Monero is abbreviated as XRP, and the 'X' seems out of place for the initials meant to denote Monero as a digital asset. So does Tether with USDT.

It seems it's easier to recognize both Altcoins: Bitcoin Cash and Bitcoin SV recognized as BCH and BSV, respectively.

Why are there so many Altcoins?

Every blockchain has its protocols. Developers tweak the rules of each blockchain to suit their user preferences. However, pertinent features of the blockchain remain - like the peer-to-peer transaction model.

The reason for the rise of the many Altcoins can be attributed to the following reasons (and many more):

- The clamor for better privacy when effecting transactions

- Preference for Decentralized networks

- Other key features that the BTC blockchain does not offer

Altcoins are a result of the blockchain being put to use, both for storage of value and the various uses that are aligned to user requirements.

The 'alt' prefix in term- Altcoin borrows much from the alternative coins to BTC.

On a peculiar note, most altcoins roll out, seeking to fix a fallacy they perceive with the Bitcoin blockchain. One outstanding example is between Bitcoin with slower transaction speeds when compared to Litecoin.

How Altcoins Work

There's no fundamental difference between how Bitcoin and Altcoins work. The usual applies across the board. If you require sending Altcoins, the private key features apply for you to authenticate the transfer from your wallets to those of recipients.

Behind the scenes, indelible records update on the blockchain, making them undeniable across all the network users. So, once a transaction passes approval stages, the complex mathematics updates the records within blocks or ledgers.

Altcoins and Market Capitalization

The value of digital currencies has a significant bearing on their grand totals that exist within the market. Each one of them has a varying value that derives from underlying factors. These factors mentioned above spread out into both intrinsic and incidental outcomes.

In to finer details, the market cap per digital assets is the total of:

- Total cumulative worth in the open market

- The total perceived worth as part of speculation arising from future economic happenings

For instance, according to coingecko, Ethereum is ranked second of all listed digital assets in terms of market cap and market ranking.

BTC leads in position one, commanding the highest market cap estimated at around $117Billion. It's arrived at by multiplying the market value per Bitcoin by the number of Bitcoins in the entire market. Altcoins on a comparative scale have lower market caps than that of Bitcoin.

In reality, every market cap is not constant, and it keeps shifting with respect to the market price per unit of the Altcoin. Closer looks indicate Altcoins competing to gain market value away from BTC, which seems so stable, drawing from its position as the most valued digital asset.

Into the future, one of the Altcoins may outdo BTC on both parameters: market value and position.

Comparative Features Between Altcoins and Bitcoin

Following Bitcoins' launch in January 2009, Namecoin hit the digital-assets space in April 2011. And what followed was the craze in rollouts of other Altcoins. Most of them bounced into the picture in the year 2015.

In retrospect, Altcoins launched to compete. Their order was Ripple, Litecoin, Mastercoin, Feathercoin, and Counterparty.

The Altcoin dev teams tweak the codebase from what's available for BTC, test, test, and finally roll out.

Dash and Zcash emerge from successful tweaks of BTC. One other method in which Altcoins arise is through forking.

Forking allows blockchain users with a sizable stake to take control and change protocols under their consensus. Forks of Ethereum have emerged into new networks like Wanchain and Ubiq.

Here is a precise circumstance with the rules for mining of BTC and Litecoin. BTC adds to the blocks every ten minutes, while Litecoin achieves the same at a faster rate. Comparatively, the Litecoin blockchain adds updates every interval of two-and-a-half minutes.

On the total number of coins mineable scale, Bitcoin has only twenty-one million, while Litecoin is four-fold at eighty-two million.

Mining Bitcoins and Altcoins

The mining process facilitates proving the existence of a digital asset. It culminates with the asset being added to a block or a ledger on its respective blockchain.

When it comes to resource requirements for mining, Bitcoin requires both advanced and pricey hardware. Looking at Litecoin, ordinary PCs owners can mine. And that creates the distinction. In real terms, mine-ability is one underlying factor fueling the rise of Altcoins.

Image source: Graphs- https://coinmarketcap.com/

Every Altcoin adheres to the protocol of its hosting blockchain. Blockchains exhibit vast similarities but deviates with distinguishable characteristics on a per Altcoin specific terms. The specific array is notable on both fronts of functionality and usability.

So, the mining of Altcoins is relatively more straightforward when compared to that of BTC. The current picture exhibits a scene of more value in place of mining difficulty.

How exactly are Altcoins Mined?

Users with access to both hardware and software can venture into mining solely. With this, you pay the bills for power and maintenance.

Aside from the mining model above, you can join a mining pool. In essence, you collectively contribute to the host of mining resources. Eventually, you take a share of the rewards in line with the applicable agreements.

Also, mining enthusiasts with capital and neither software nor hardware have an opportunity to mine. They do their due diligence and venture into cloud mining.

Take Away Note on Altcoins and Why Join Us

Almost a decade ago, crypto was a vague thought. Right now it's almost $270 Billion worth, and still growing.

Does the Crypto-sphere excite you? Think about the knowledge and value.

If you are an expert or just starting, an individual or firm, welcome and join us.

We share knowledge and gain in value. Here's our link.

Knowledge doesn't hurt, and that's our focus.